Pay As You Go Auto Insurance From CAA MyPace

September 4, 2020.

CAA MyPace insurance provides you with coverage wherever the road does (or does not) take you. MyPace allows you to pay for, manage, and reduce your insurance premiums if you drive less than 9,000 kilometers per year. Therefore, you’ll pay only for the distance you need, so you can go at your own speed!

What is CAA MyPace Insurance?

CAA MyPace is a payment plan that gives you control to manage your auto insurance. You decide when, or if, you need to buy more kilometers to suit your driving habits. Use your kilometers and reduce the cost of your premium without compromising coverage.

Is CAA MyPace Insurance right for me? Do I qualify for MyPace?

CAA MyPace is for those who have a drive-less lifestyle. Those driving less than 9,000 kilometers a year will experience cost savings by switching to MyPace. Those driving more than 9,000 kilometers in a year will benefit from a traditional auto insurance policy.

How does CAA MyPace Insurance work?

CAA MyPace insurance starts with a base rate to protect your vehicle while it is parked. This is the base non-km rate. In addition to the base non-km rate is the increment rate. The increment rate is your coverage per 1,000 kilometers while driving. The first payment term includes the base non-km rate and one 1,000-kilometer increment.

How do I add more kilometers to my CAA MyPace policy?

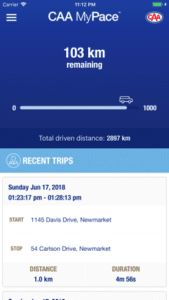

As you approach the end of an increment rate, you will receive a notification that your kilometers are running low. Another 1,000 kilometers will automatically reload when 50 kilometers remain, so you never run out. Or, you can choose when it reloads by pausing the payment. New increment rates will not show on your dashboard until you use the remaining 50 kilometers from the previous increment. The dashboard will then reset to show the new 1,000 kilometers remaining on your policy

Back to All Blogs

An Introduction to CAA MyPace

What if I drive over 9,000 kilometers under CAA My Pace Insurance?

An admin fee will apply for every increment over 9,000 kilometers. CAA MyPace rewards those who drive less with cost savings. Therefore, if you typically drive over 9,000 kilometers a year, you may be benefit from a traditional auto insurance policy.

What if I do not use a kilometer increment at the end of my CAA My Pace Insurance policy term?

MyPace will carry over any unused kilometers in your current increment rate upon renewal. You do not need to reload as you approach the end of your policy term. Therefore, once you use the kilometers carried over from your previous policy term, you will be billed for a new increment at the rate of your current renewal term.

How do I access the CAA MyPace Dashboard?

Download the CAA MyPace dashboard as an app to any iOS or Android device.

Alternatively, if you do not have a smartphone, you can access the MyPace dashboard through the online customer portal. All you need is a valid email address.

Does CAA MyPace Insurance cover all vehicles?

No. Some vehicles are not compatible with the MyPace program device. This includes but is not limited to:

- Electric vehicles,

- Diesel vehicles with a model year of 2005 or older,

- All vehicles older than 1997, and

- Motorcycles

*Please note, some vehicles may be incompatible due to unforeseen circumstances.

Can I enroll multiple vehicles under CAA MyPace?

Currently you can only register one vehicle per MyPace policy. However, you may have multiple vehicles insured with a MyPace policy. The CAA MyPace app or online portal will list all vehicles that apply.

How do I enroll in CAA MyPace Insurance?

Enroll in CAA MyPace Insurance in four easy steps:

- Enroll in MyPace and pay your base rate plus your first 1,000km,

- Install the MyPace device in your car,

- Download the MyPace App to your smartphone, and

- Drive!

It is that simple.

As your Hometown Broker, we care deeply for our clients and our community. We are unconditionally committed to helping and servicing our valued clients anyway we possibly can! Our offices remain open to all our clients via phone at 1-855-385-4226, email at [email protected] or text at 289-802-1843.

What if I drive over 9,000 kilometers under CAA My Pace Insurance?

An admin fee will apply for every increment over 9,000 kilometers. CAA MyPace rewards those who drive less with cost savings. Therefore, if you typically drive over 9,000 kilometers a year, you may be benefit from a traditional auto insurance policy.

What if I do not use a kilometer increment at the end of my CAA My Pace Insurance policy term?

MyPace will carry over any unused kilometers in your current increment rate upon renewal. You do not need to reload as you approach the end of your policy term. Therefore, once you use the kilometers carried over from your previous policy term, you will be billed for a new increment at the rate of your current renewal term.

How do I access the CAA MyPace Dashboard?

Download the CAA MyPace dashboard as an app to any iOS or Android device.

Alternatively, if you do not have a smartphone, you can access the MyPace dashboard through the online customer portal. All you need is a valid email address.

Does CAA MyPace Insurance cover all vehicles?

No. Some vehicles are not compatible with the MyPace program device. This includes but is not limited to:

- Electric vehicles,

- Diesel vehicles with a model year of 2005 or older,

- All vehicles older than 1997, and

- Motorcycles

*Please note, some vehicles may be incompatible due to unforeseen circumstances.

Can I enroll multiple vehicles under CAA MyPace?

Currently you can only register one vehicle per MyPace policy. However, you may have multiple vehicles insured with a MyPace policy. The CAA MyPace app or online portal will list all vehicles that apply.

How do I enroll in CAA MyPace Insurance?

Enroll in CAA MyPace Insurance in four easy steps:

- Enroll in MyPace and pay your base rate plus your first 1,000km,

- Install the MyPace device in your car,

- Download the MyPace App to your smartphone, and

- Drive!

It is that simple.

As your Hometown Broker, we care deeply for our clients and our community. We are unconditionally committed to helping and servicing our valued clients anyway we possibly can! Our offices remain open to all our clients via phone at 1-855-385-4226, email at [email protected] or text at 289-802-1843.