For many Canadians, the cost of dental care has been a long-standing barrier to consistent oral health. Recognizing this gap, the federal government introduced the Canadian Dental Care Plan (CDCP) – a program designed to help make dental care more accessible and affordable for millions of Canadians without private insurance.

With phased enrollment and expanded services rolling out throughout 2024 and into 2025, understanding who qualifies, what’s covered, and how much families are entitled to can help you prepare and make the most of this new support system.

Who Is Eligible?

The Canadian Dental Care Plan is intended for Canadian residents who do not have access to dental insurance and meet certain income-based and tax-filing criteria. Eligibility is based on household income and age, and applicants must have filed a tax return in the previous year to qualify.

The plan is being introduced in stages. As of now, seniors, children under 18, and certain other groups are eligible to apply. Broader access is expected in 2025, with applications expanding to more age groups and family types.

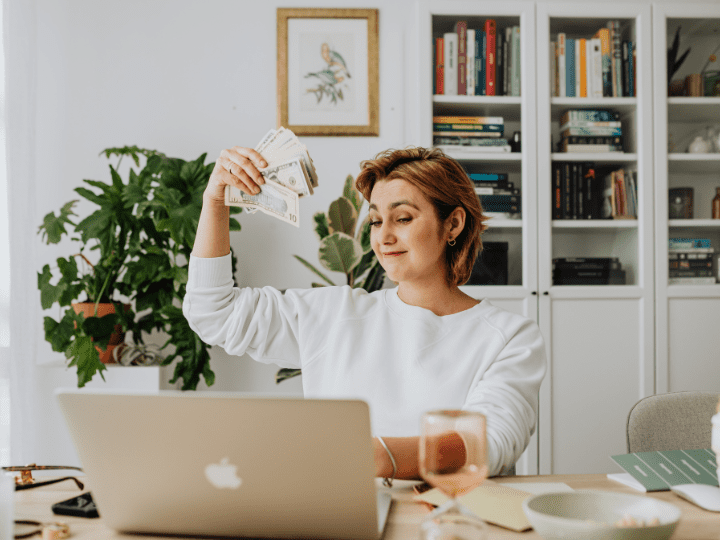

According to the Government of Canada, household income thresholds determine the level of coverage. For those making less than $70,000 annually, the plan may cover 100% of eligible dental costs. For households earning between $70,000 and $89,999, coverage is offered at reduced percentages, and some co-payments may apply. This sliding scale ensures that support is available based on financial need. [source: Government of Canada]

What Dental Services Are Covered?

The CDCP focuses on covering essential and preventative dental care. As of July 2024, Canadians who qualify can expect the plan to include:

- Exams and cleanings

- X-rays

- Fillings and root canal treatments

- Scaling and polishing

- Dentures and extractions

- Periodontal services (for gum disease)

- Minor oral surgeries

These services are covered when provided by a participating oral health provider and are deemed medically necessary according to the program’s criteria.

While not every service is covered in full, many basic and preventive services that were previously unaffordable for some Canadians are now accessible. More complex treatments and specialist care may require preauthorization, especially if they are higher-cost services or outside the standard care parameters.

It’s worth noting that the CDCP works only with participating dentists, dental hygienists, and oral health providers who have enrolled in the program. Patients should confirm with their provider whether they participate in the CDCP before booking an appointment. [source: Government of Canada]

How Much Are You Entitled To?

The amount of coverage depends on your household’s income level:

- 100% coverage for households earning under $70,000

- Partial coverage (with co-payments) for households earning between $70,000 and $89,999

- No coverage for households above $90,000 or those with access to private dental insurance

There is no fixed dollar amount per person; instead, the program covers eligible services up to predetermined fee guide amounts. If your provider charges more than the fee covered under the CDCP, you may be responsible for paying the difference.

The plan is structured to support Canadians based on need, and coverage is intended to align with provincial dental fee guides. This helps ensure consistency in what is reimbursed and minimizes confusion for patients and providers alike.

Why This Matters

Oral health is a critical part of overall well-being. Untreated dental issues can lead to infections, nutritional problems, and chronic pain. For many lower-income families and uninsured individuals, dental care has often taken a back seat to other essential needs.

The CDCP aims to change that by removing cost as a barrier, providing support for regular checkups, cleanings, and necessary treatments. As the program continues to roll out, it’s expected to benefit nearly 9 million Canadians.

_

The Canadian Dental Care Plan is a significant step forward in ensuring equitable access to oral health care across the country. If you or your family members don’t currently have dental insurance, it’s worth checking your eligibility and connecting with a participating dental provider.

Searching for help to understand how dental benefits fit into your overall insurance plan? Our team can help you explore health, life, and supplemental insurance options to ensure you’re protected from every angle. Contact us today, to get started.