Ending the Stigma Around Canadian Millennials

July 8, 2021

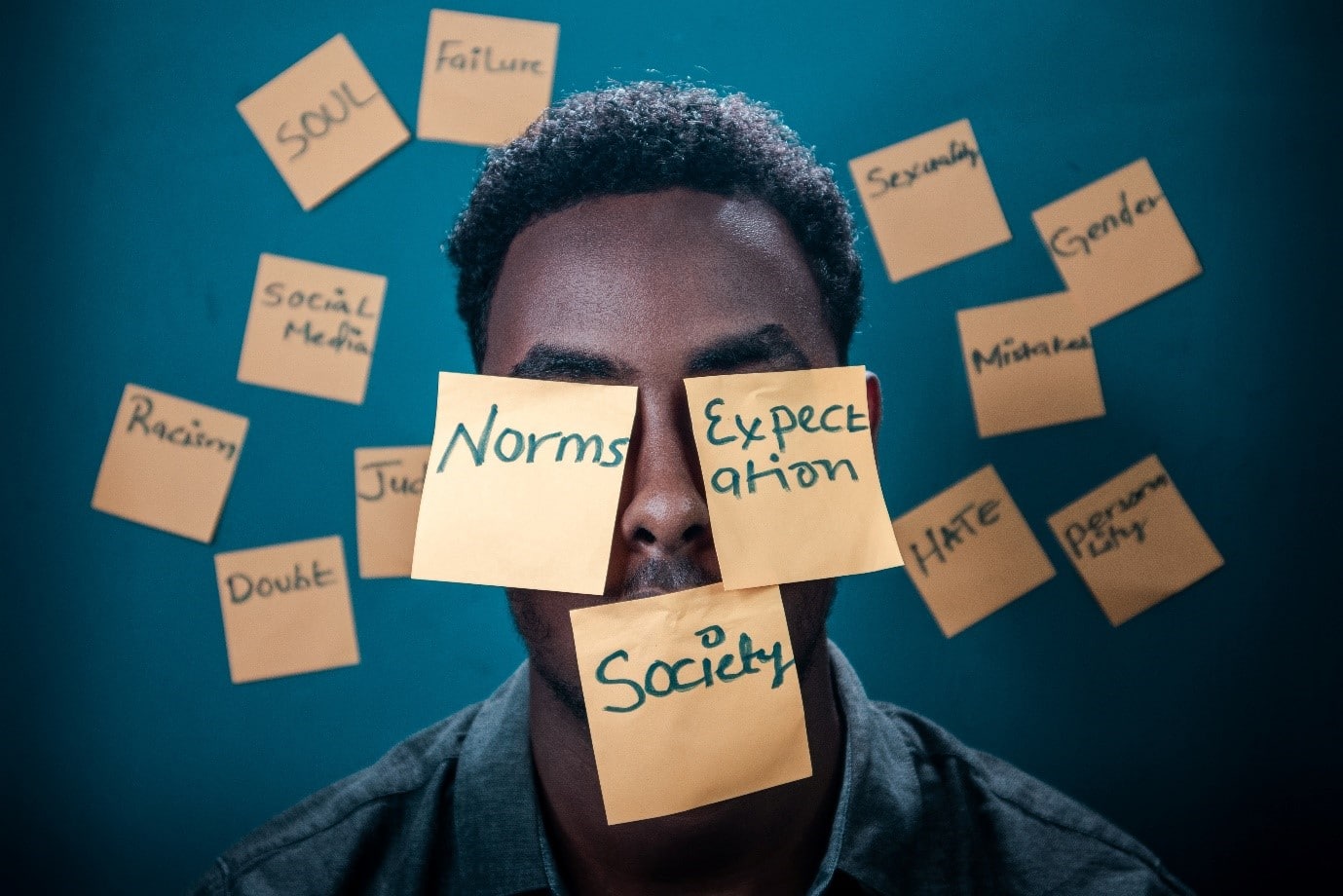

The stigma that millennials are lazy often comes to mind when baby boomers or Generation Xers hear about millennials moving back in with their parents. But are the negative stigmas and stereotypes true?

Compared to the baby boomers or Generation X, millennials are more likely to move back home with their parents, start families later, and wait longer to get married. Despite working hard, Canadian millennials face different economic, social, and political circumstances than the previous generations.

An increasingly unaffordable housing market in the Golden Horseshoe area relative to the average income makes homeownership, and sometimes renting, nearly impossible. This change in circumstances can mean that moving back home is a smart move on behalf of Millennials trying to improve their financial situations.

Top Reasons why Millennials Move Back in With Their Parents

A high cost of living and rising inflation compared to wages creates unique challenges for millennials to overcome. On average, a one-bedroom apartment in Toronto costs $2,300, but Ontario’s minimum wage only being $14.35.

Even if a person worked full-time, this salary could not cover an average rental cost, let alone electricity, water, food, childcare, insurance, or other essentials. Consequently, many Canadian millennials are struggling to build wealth and become financially independent from their parents.

In contrast, baby boomers and Generation X earned more relative to their expenses, making it easier to enter the housing market. For example, an average person born in the 1950s had to work and save full-time for five years to afford a down payment on a house. An individual today would have to work 24 years to save enough for a home in the Greater Toronto Area.

The Pursuit of Higher Education

Many baby boomers started their families and careers straight out of high school. However, Millennials are more likely to pursue post-secondary education and obtain their Bachelor’s, Master’s, or Ph.D. However, a prolonged education has created increased student loan debt and pressure to pay it off post-graduation.

By living at home during their studies, many Canadians save money on rent, transportation, and other expenses they would accumulate if they move out independently. The expectation of better career opportunities and a higher salary motivated many millennials to continue their education and stay home to reduce the cost.

Inflation Outpaces Income

Making end’s meat has become more challenging for young Canadians since the Great Recession in 2009. During this time, many millennials were graduating college and entering the workforce. Unfortunately, this generation of professionals faced limited job opportunities, inflation, and low salaries.

Today, the average prices for rent in Toronto are 13% higher, childcare is 30% more expensive, and public transit prices went up 36% compared to 2008. But, the salaries have not increased proportionately, forcing many millennials to search for alternative saving solutions. Additionally, fewer full-time jobs are available. Instead, many new positions are for part-time, contract, and gig workers.

As a result, many Canadians have to either move further outside the city or accept lower-paying jobs. Urban centers like Toronto are ideal areas for talented and educated professionals to search for work. But, the housing prices often translate into lengthy, expensive commutes from residential areas outside the city. As rent and mortgage prices continue to rise in more remote areas, the housing crisis has become increasingly problematic.

Canadian Housing Prices Skyrocketed

The current housing prices in the Golden Horseshoe and Toronto area have skyrocketed in the past decade. Now, the average cost for a detached house in Toronto is $1.75 million. A resulting housing affordability crisis is preventing many educated, hard-working millennials from achieving their homeownership goals.

Consequently, the dream of owning a home has become an unrealistic fantasy. Without the family members’ and relatives’ help with their first home purchase, many millennials cannot afford the down payment for a mortgage.

Recently, Canadians have drawn more attention to the housing crisis, urging governments to take legislative action. For example, increasing bidding transparency, introducing vacancy taxes, and increasing taxes on investment properties are ways Canadians pushed for sustainable housing prices.

Millennials are Taking Financial Responsibility

One study suggests that millennials are smarter with money than the generations before them. For example, millennials are more likely to have written financial plans than baby boomers and know more about wealth accumulation. Despite maintaining balanced household budgets, these efforts are not enough to meet the rising costs of living.

By moving back with their parents, many millennials can finally take the steps they need toward financial freedom. Many individuals make the most of the little money they have, saving or investing it in building future wealth. For example, a portion of the money saved could go towards protecting assets like your car or side hustle workspace.

In this way, many millennials are putting their creative problem-solving and financial skills to the test. Instead of spending their entire income on rent, many millennials leverage long-term wealth-building strategies to supplement their meager incomes while living at home.

This sense of financial responsibility drives many millennials to move back home. By paying their car insurance, credit card, and student loan payments on time, millennials can start building credit, improving their chances of homeownership down the line.

Learn More About Ending the Millennial Stigma

Despite having a reputation for being lazy, selfish, and unmotivated, the stigmas about millennials are an unfair assumption that does not consider the current economic climate. A generation struggling to cope with inflation and low salaries should not have to let go of its homeownership goals.

At Duliban Insurance Brokers, we help millennials find alternative ways to grow wealth. Our insurance products and services can help you feel protected on the path towards your dreams. Once you have purchased your first house, we protect your investment with a comprehensive Homeowner Insurance policy.

Contact us to learn more about ending the stigma about millennials. We look forward to helping you and answering your questions.