Ontario Auto Insurance Changes 2026: What Drivers Need to Know About the New Auto Reform

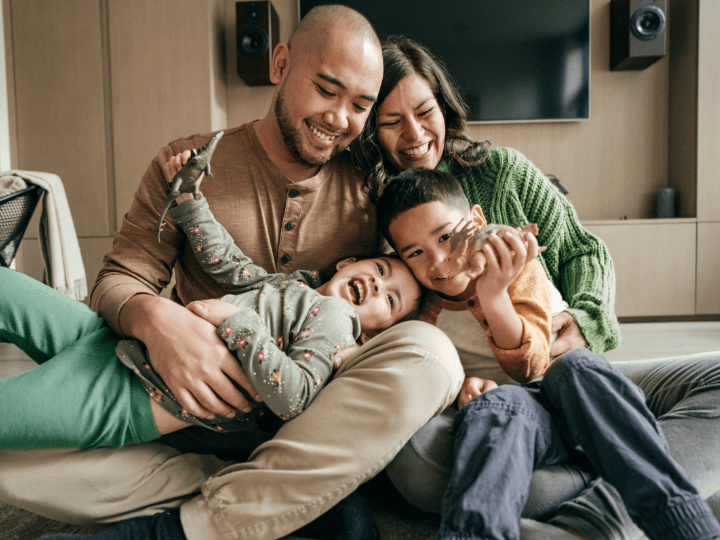

Ontario’s auto insurance reform takes effect July 1, 2026. The new modular system makes many accident benefits optional, allowing drivers to customize coverage and potentially lower premiums, but increasing the risk of coverage gaps if key protections are removed. Big Changes Are Coming to Your Car Insurance Starting July 1, 2026, Ontario will introduce what’s called a modular or à la carte auto insurance model. Instead of every driver automatically paying for the same package of accident benefits, you will be able to choose the coverage that fits your needs and financial situation. The goal of this change is to give drivers more flexibility and, in some cases, reduce premiums. However, more choice also means more responsibility when it comes to protecting yourself and your family. These changes are part of the province’s broader auto insurance reform and are being implemented under the oversight of the Financial Services Regulatory Authority of Ontario (FSRA). What You Must Keep and What You Can Skip After July 2026, only three core accident benefits will remain mandatory: Medical care Rehabilitation Attendant care These cover essential treatment and support if you are seriously injured in a collision. Everything else will become optional, including: